Abundance, Scarcity, and New Mexico’s Permanent Fund Part 3: Objections

Originally Published on LinkedIn on August 26, 2025

Recently, I proposed using a significant portion of New Mexico’s Permanent Funds, up to 50%, to invest in a dynamic growth strategy for the economy of New Mexico. There are several objections to this strategy, and I want to address those objections. The strongest ideas must stand up to the scrutiny of objections, or they are not worth pursuing.

Initially, I was going to do a single article on all objections. However, the objection below is the primary objection and so it deserves its own discussion. I will review other objections in a later post.

Objection 1: Oil and gas revenues will decline as the Permian Basin depletes in 15–20 years. We must grow the Permanent Funds now to sustain the state government through future investment income.

To add some detail to the objection, currently, the revenue from oil and natural gas, which funds approximately 30% of our annual state budget, will soon run out, and we will need the revenue from the income of state permanent funds to cover the shortfalls in state revenue. This is a legitimate concern, but one I believe is short-sighted.

There is no consensus on when our state will run out of oil reserves. Part of it depends on the price of oil, and the other is how easy it is to tap the reserves of oil below New Mexico. The most aggressive forecasts have oil production levels peaking in the next few years, followed by a decline over the next 20 years. Others believe that with increases in technology, there are enough reserves in the Permian Basin to last generations.

The reason I say that hoarding the income the state generates from oil and natural gas leases in the Permanent Fund is short-sighted is that it only addresses one of the two problems resulting from the loss of oil and natural gas revenue. It only addresses the state government income problem; it does nothing to solve the impending economic crisis that would result from the collapse of an industry so vital to the New Mexico Economy.

Let’s do a thought experiment. This is not a scenario I believe, but it is the base rationale behind the hoarding strategy currently employed by the state. Let’s say that between 2035 and 2040, oil and natural gas production in New Mexico drops by 75%.

According to a study by the State Finance Committee, by 2039, the income from the State’s Permanent Fund will exceed the current revenue from oil and natural gas. This is a wonderful thing to have if you are only concerned about the state budget. Yes, in this scenario, I fully agree that saving money in the State’s permanent fund will help maintain the state budgets at their current levels and would replace income lost by oil and natural gas leases. However, there are two other issues that this completely ignores.

The first issue is that it does nothing in the next 15 years to change our state’s trajectory. Wallet Hub recently ranked New Mexico as the worst state to live in. Hoarding the money in the permanent fund does nothing to change this trajectory. We continue to rank in the bottom 10 of US States in healthcare, education, and our economy. We need to diversify our economy and broaden our tax base. Otherwise, in 15 years, we will still be the worst state to live in, with a different income stream funding our state budget.

The second and bigger issue is that a 75% drop in oil and natural gas production would be a devastating blow to our economy. Socking away money in the permanent fund would do nothing to reduce the blow from such a loss; it would only ensure that the state budget wouldn’t be hit. Think of it, if an entire industry becomes obsolete, not only do the significant job losses from the industry itself impact the economy, but the ripple effect of the loss extends to all small businesses that support that industry. In this case, across the Southeastern Counties of New Mexico, the oil and natural gas jobs are gone, but so too are the restaurant, transportation, and every other business supporting those jobs…gone. In this scenario, these communities are gutted because we were so scared of losing the revenue to the state that we chose not to diversify our economy when we had the chance. Instead, we placed the tremendous asset that is the Permanent Funds in bond funds and similar type investments outside the state of New Mexico, where they continue to grow but have no real impact on the economy or people of New Mexico.

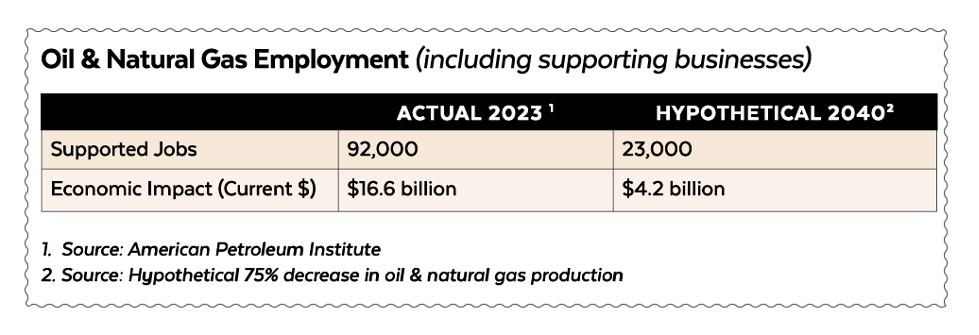

Depending on the source, Oil and Natural Gas production in New Mexico supports 9%-12% of the jobs in New Mexico. According to a report by the American Petroleum Institute in April 2023, Oil and Natural Gas employs 92,000 people and provides $16.6 billion to the New Mexico Economy. A 75% drop would mean 69,000 people would be out of work, and the state would lose $12.45 billion in economic activity.

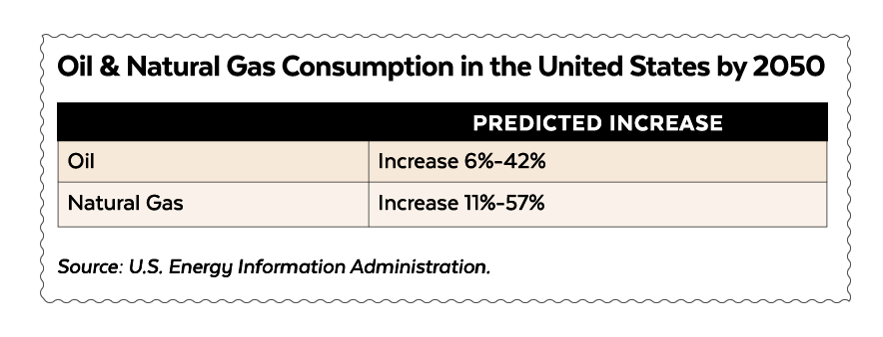

To be clear, I don’t believe this is the scenario that is going to play out. The need for oil and natural gas is only going to increase in the next 25 years. According to the United States Energy Information Administration, oil consumption will increase between 6%-42% by 2050, and natural gas consumption will increase between 11%-57% by 2050. In addition, the Permian Basin is likely to continue as a significant oil producer by 2050.

Clearly, the first alternative future where we run out of oil in the next 15 years, reveals that socking away revenue in the Permanent Fund becomes more ludicrous. The urgency to diversify our economy now becomes even more critical. We can and should cultivate and attract other industries so that any reduction in oil production does not limit our state's revenue and, more importantly, so that the communities that rely on oil and natural gas for their way of life have other economic opportunities available to them.

Conversely, the alternative future where we don’t run out of oil and natural gas in the next 15 years. The same rationale holds even if the urgency is diminished. Let’s diversify our economy so that we are not reliant on any one industry.

The concern that the revenue the state receives from oil and natural gas will drop is a legitimate concern. However, the current strategy of creating a trust fund-type income stream to fund state government only solves part of the problem. It will not diversify the state’s economy, nor will it replace the jobs lost from a decrease in oil and natural gas production. We need a comprehensive solution.

Let’s think of a different future. One where New Mexico invests $30 billion of its current nest egg in its future. A future where, by 2050, New Mexico is a top 10 personal income state, moving beyond our current rankings of last or near last in state income and wellness rankings. We have the assets to do this, not only monetarily but in the people of this great state. Let’s stop settling. Let’s take this incredible asset we have in the Permanent Fund and invest it in New Mexico and New Mexicans.